AQR Capital Management LLC

Last Updated: 12/3/2020

AQR Capital Management LLC is a Limited Liability Company that started in 1998 and is primarily owned and controlled by Clifford S. Asness.

Per its ADV, AQR specializes in quantitative investment analysis, which relies on proprietary models, utilizing a set of value,

momentum, and other factors, to generate views on positions and applying them in a disciplined and systematic

process. AQR provides investment advice to its Clients (as defined below) on a variety of securities and instruments

in accordance with agreed upon investment objectives and strategies.

AQR Capital Management LLC operates out of an office in Greenwich, CT. Based on the Form ADV filed on 2020-05-28 00:00:00, the investment firm is comprised of 928 employees, only 389 of whom performs investment advisory functions.

Fact Sheet

- Name: AQR Capital Management LLC

- CRD No: 111883

- Filing Recorded: 2020-05-28 00:00:00

- Year of Origin: 1998

- Employees: 928

- Clients: 424

- AUM: 249,000,000,000

- Management Fee: .10 to 2.55 Percent

- Performance Fee: up to 30 Percent

- Client Type: Investment Companies, Pooled Investment Vehicles, Pension and Profit Sharing Plans, State or Municipal Government Entities, Soverign Wealth Funds and Foreign Official Institutions

- Assets Traded: Exchange-Traded Equity Securities, US Government/Agency Bonds, Soverign Bonds, Non-Investment Grade Corporate Bonds, Derivatives, Securities Issued by Registered Investment Companies or Business Development Companies, Cash and Cash Equivalents

Contact

- Website: https://www.aqr.com/

- Email: [email protected]

- Telephone: 203-742-3600

- Address: Two Greenwich Plaza 3rd Floor, Greenwich, CT 06830

Investment Strategy

According to the brochure submitted to IAPD, AQRs investment strategy is as follows:

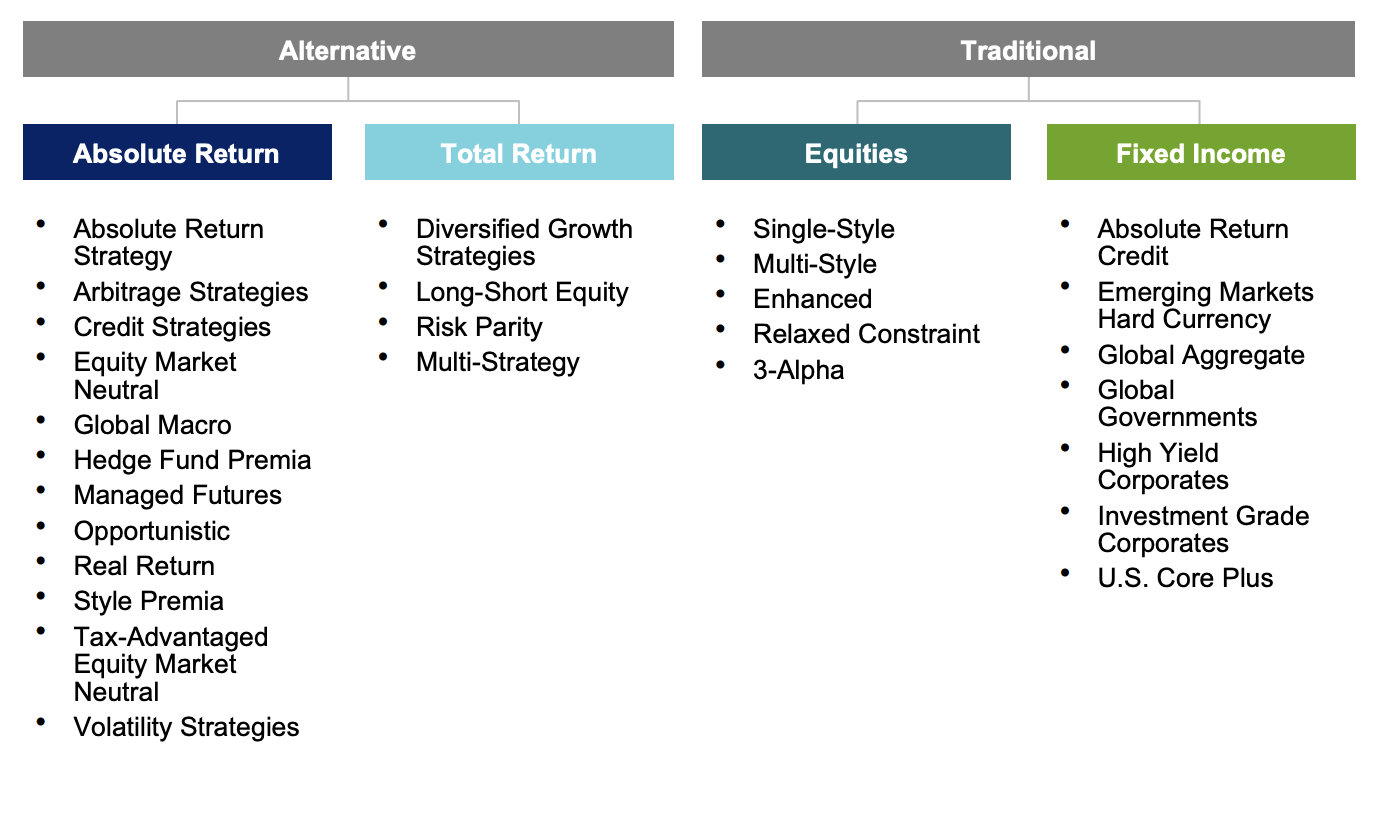

The Adviser utilizes several investment strategies, including both alternative and traditional investment strategies. With regards to alternative strategies, AQR offers both absolute return strategies, which target zero exposure to traditional markets, either at all times, or on average; and total return strategies, which maintain some exposure to traditional markets. Each of these investment strategies is managed by a team of portfolio managers in a manner consistent with our approach to investing.

Methods of Analysis

In addition, AQRs methods of analysis include:

Advisory Business, AQR specializes in quantitative investment analysis, which relies on proprietary models, utilizing a set of valuation, momentum, and other factors, to generate views on securities and applying them in a systematic process.

Quantitative investment analysis is a method of evaluating securities and other assets by analyzing a large amount of traditional and non-traditional data through the use of algorithms—or models—to generate investment decisions. AQR’s models may consider a wide breadth of factors, including, for example, traditional valuation measures, momentum indicators, price signals, textual analysis of financial reporting and terms of trade information. These diverse sets of inputs, combined with AQR’s proprietary signal construction methodology, optimization process, and trading technology, are the foundation of AQR’s investment process.

AQR performs research internally. Once an investment approach is identified, AQR builds a model to test the strategy’s viability. The model building process generally consists of two steps: (1) designing an investing strategy to implement the given approach; and (2) producing testable implications. AQR performs ongoing research to monitor and maintain the effectiveness of its models over time. External data (e.g., Reuters, Bloomberg and other data services) is used by AQR in developing its quantitative forecasting computer models.

In addition to quantitative investment analysis, AQR may also utilize discretionary and/or hybrid strategies through a combination of quantitative and fundamental techniques. There are certain risks specific to firms specializing in quantitative investment analysis. Please see below under “Investment Risks” for a summary of some of the risks specific to quantitative investment analysis.

Top 10 Holdings from Form 13F

Reporting Period: 09/30/2020

| Issuer | Share | Value(1000s) | Put/Call |

|---|---|---|---|

| APPLE INC | 18,215,806 | 2,108,662 | |

| MICROSOFT CORP | 8,991,615 | 1,873,853 | |

| AMAZON COM INC | 521,032 | 1,640,589 | |

| FACEBOOK INC | 4,119,255 | 1,078,833 | |

| ALIBABA GROUP HLDG LTD | 3,619,662 | 1,064,108 | |

| ALPHABET INC | 547,802 | 802,859 | |

| JOHNSON & JOHNSON | 4,696,274 | 690,728 | |

| INTEL CORP | 12,964,056 | 671,279 | |

| PROCTER AND GAMBLE CO | 4,787,799 | 661,626 | |

| TAIWAN SEMICONDUCTOR MFG LTD | 7,683,120 | 622,871 |

Historical 13F Filings

EdgeGiant has compiled all 13F filings since Q2 2013 for your convenience. You can view historical portfolio position forAQR Capital Management LLCin our 13F section HERE.

To get the comprehensive list of holdings that fall under 13F regulatory guidelines, check out our write up on how to access and use 13Fs in your personal investment decisions.