Trading With Giants

How to Tell What Stocks Warren Buffet Owns

Piggybacking off the greatest investor in the world.

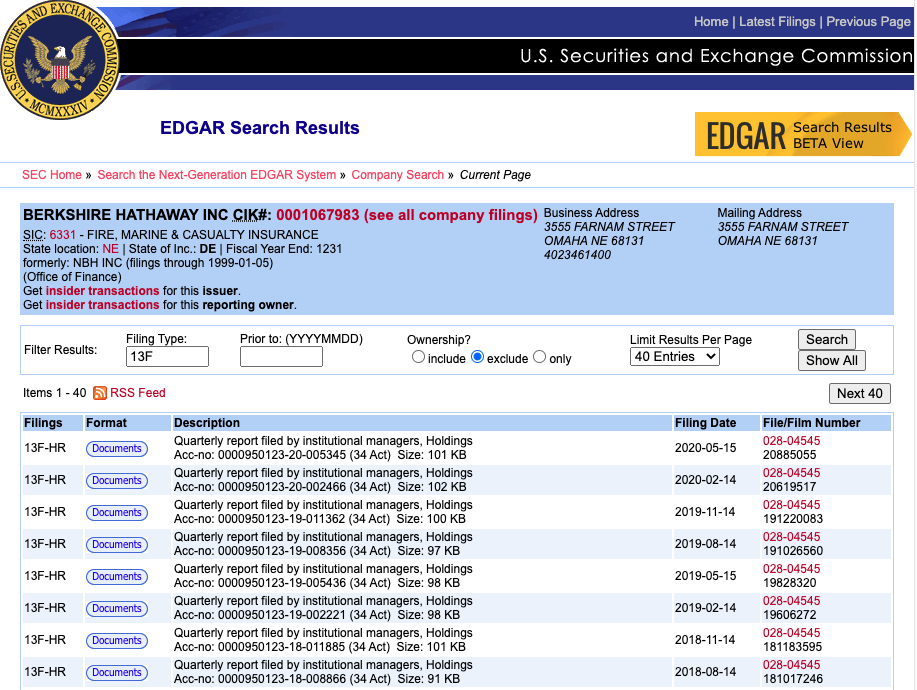

What does the greatest investor of all time own in his current portfolio? How do we learn from the Oracle of Omaha and test our own investment prowess against this legendary trader? Well, to get a glimpse of his company holdings, we make use of the latest 13F Filings made by his company, Berkshire Hathaway (BRK-A).

What is a 13F Filing?

Institutions that manage money in excess of $100 million dollars is required to make a quarterly filing with the Securities and Exchange Commission. This filing must be completed within 45 days of the end of a calendar quarter, and will include ownership of any 13(f) securities in the investment manager’s portfolio, including the number of shares held at the end of the calendar quarter. 13(f) securities are generally exchange traded equity positions as well as some derivatives, certain closed-end investment companies, along with some convertible debt securities. The current running list of 13(f) securities can be found on the SEC Website

The SEC webpage is an indispensable tool in an investor's due diligence toolkit, as it provides an easy

and consistent method of accessing company financials and other important regulatory filings. Looking specifically

at Bershire Hathaway's submissions, we can easily retrieve the latest 13(f) filings to peek inside the

magic ball and gain a little insight into Warren Buffett's style of investing.

Depending on when you discovered this article, the information provided here on Berkshire's holdings may be outdated, but the SEC's website will link you to the latest 13(f)s so you can keep track of Buffett's latest move, like his recent decision to liquidate his airline holdings in the height of the Covid-19 pandemic. For the sake of learning, we've pulled up the top 10 holdings in Berkshire's portfolio as of the first quarter of 2020, priced to the market value at the end of Q2.

Berkshire Hathaway Top 10 Holdings

| Company | Symbol | Shares | Price | Market Value (millions) |

|---|---|---|---|---|

| Apple Inc | AAPL | 245,155,566 | 364.80 | 89,432 |

| Bank of America | BAC | 925,008,600 | 23.75 | 21,968 |

| Coca-Cola Co | KO | 400,000,000 | 44.68 | 17,872 |

| American Express Company | AXP | 151,610,700 | 95.20 | 14,433 |

| Kraft Heinz Co | KHC | 323,212,918 | 31.89 | 10,307 |

| Wells Fargo & Co | WFC | 323,212,918 | 25.60 | 8,274 |

| Moody's Corporation | MCO | 24,669,778 | 274.73 | 6,777 |

| JPMorgan Chase & Co. | JPM | 57,714,433 | 94.06 | 5,428 |

| U.S. Bancorp | USB | 132,459,618 | 36.82 | 4,877 |

| Bank of New York Mello Corp | BK | 79,765,057 | 38.65 | 3,082 |

Outside of his massive position in AAPL, Berkshire is heavily committed to the US Financial Sector. How does that compare to your own investment philosophy? How has his (and Charlie Munger's) view on the economy changed over the course of this roller-coaster ride of a year? Looking at Berkshire's holdings may not help you predict Warren Buffett's next move, but it may help guide your personal investment decisions to track more closely to that of the greatest investor of all time.